0800 000 10 Contact Centre

+373 22 27 07 07 for international calls

Legal address: bd. Ștefan cel Mare și Sfânt, nr. 65, office 901, MD-2001, Chișinău, Republic of Moldova

Business Ethics and Environmental Standards

Business Ethics

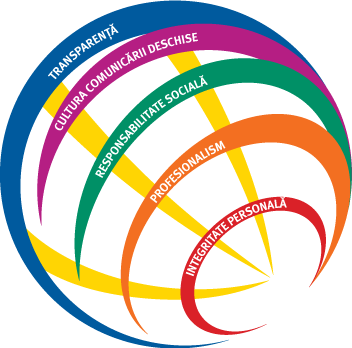

Our corporate values form the foundation of our business ethics. The following principles guide the operations of the ProCredit institutions:

- Transparency: We provide transparent information to our customers, to the general public and to our employees. For example, we ensure that customers fully understand the terms of the contracts they conclude with us, and we engage in financial education in order to raise public awareness of the dangers of intransparent financial offers.

- A culture of open communication: We communicate openly, fairly and constructively with each other. We deal with conflicts at work in a professional manner, working together to find solutions.

- Social responsibility and tolerance: We offer our clients sound, well-founded advice. Before offering loans to our clients, we assess their economic and financial situation, their business potential and their repayment capacity in order to avoid over-indebtedness and to provide appropriate financial services. In addition, we are committed to treating all customers and employees with fairness and respect, regardless of their origin, colour, language, gender or religious beliefs. We also ensure that requests for loans are evaluated in terms of the applicant’s compliance with our ethical business practices. No loans are issued to enterprises or individuals if it is suspected that they are making use of unsafe, environmentally harmful or morally objectionable forms of labour, in particular child labour.

- High professional standards: Our employees take personal responsibility for the quality of their work and always strive to grow as professionals.

- Personal integrity and commitment: Complete honesty is required of all employees in the ProCredit group at all times, and any breaches of this principle are dealt with swiftly and rigorously.

These principles represent the backbone of our corporate culture and are actively applied in our day-to-day operations. Another aspect of ensuring that our institution adheres to the highest ethical standards is our consistent application of best practice systems and procedures to protect ourselves from being used as a vehicle for money laundering, the financing of terrorism or other illegal activities. ProCredit banks do not tolerate any fraudulent activity or any other questionable behaviour from either their clients or their own employees. Staff members are trained to apply the “know your customer” principle, and to carry out sound monitoring and reporting in line with the applicable regulations. Anti-money laundering and fraud prevention policies are regularly updated and exercised throughout the group to ensure compliance with local and international regulatory standards.

The ProCredit group is committed to maintaining high ethical and business standards with regard to its economic, social and environmental impact. For additional insight into the impact of the ProCredit group’s operations, please read "Impact Report 2022".

Environmental Standards

The business policy of the ProCredit institutions is also based on ecological principles. The most important of these are protecting the environment, conserving resources and promoting measures to contain climate change.

The environmental management concept adopted by ProCredit group consists of three pillars:

Pillar 1: Internal environmental management system

ProCredit Bank Moldova is putting in place an approach to better understand and improve the sustainability of its own energy use and environmental impact. As a matter of policy, the bank pays careful attention to environmental issues when opening a new branch or refurbishing an existing one. For example, all of our furniture is made from chipboard, a recycled material. We now use energy-saving light bulbs and plan to switch to LED lamps in the very near future. To further protect the environment, we no longer install energy-intensive equipment, such as large air-conditioners. Environmental issues are an essential component of the training provided to ProCredit Bank staff at the local, regional and international level. For example, for their final project, participants in the ProCredit Entry Program are required to develop a blueprint for a green business that would not only do no harm to the environment but would even help to improve it. The bank has designated an Environmental Coordinator to be responsible for monitoring our environmental performance, and co-ordinating efforts to improve it.

Pillar 2: Management of environmental risk in lending

ProCredit Bank Moldova has implemented an environmental management system based on continuous assessment of the loan portfolio according to environmental criteria, an in-depth analysis of all economic activities which potentially involve environmental risks, and the rejection of loan applications from enterprises engaged in activities which are deemed environmentally hazardous and appear on our institution’s exclusion list. By incorporating environmental issues into the loan approval process, ProCredit Bank Moldova is also able to raise its clients’ overall level of environmental awareness.

Pillar 3: Promotion of “green finance”

ProCredit Bank Moldova aims to promote economic development that is as environmentally sustainable as possible. In 2012, we launched a programme of green finance services consisting of energy efficiency loans for private clients as well as for businesses. This initiative will also involve building relationships with suppliers of environmentally friendly equipment and services, and encouraging them to offer services bearing the EU standard energy efficiency labels. The bank aims to use its green finance services and approach to increase public awareness and understanding.